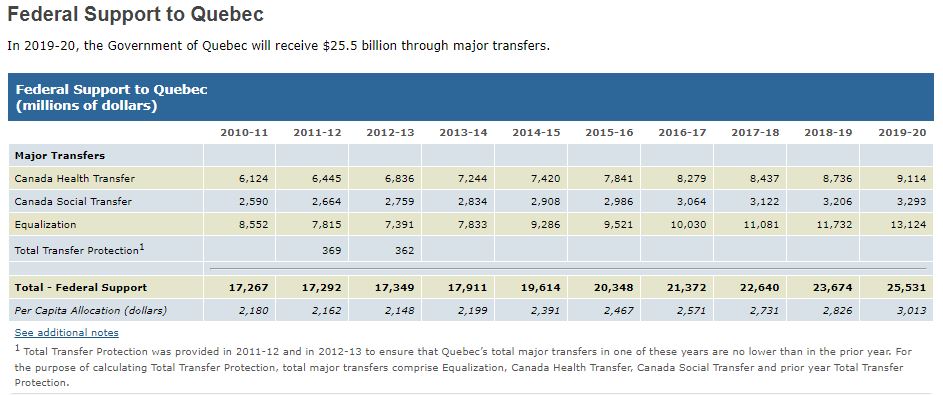

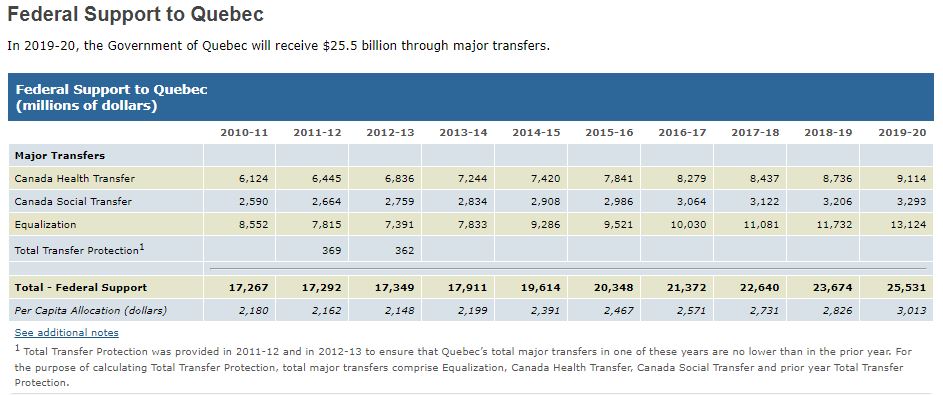

This handy link shows all the major federal transfers to provinces and territories over the last 10 years, not just equalization payments.

Here’s a random example:

It is an interesting page with interesting figures and tables but even this leaves much unsaid.

You will see equalization payments here along with the Health and Social transfers, which are often ignored. That is important.

(Why there should be Health and Social transfers is another question. To wit, why should the provinces bother sending money to Ottawa that they would otherwise just get back from Ottawa, after Ottawa takes a fat cut? For things like “social” and “health” that the provinces are supposed to be responsible for anyway?)

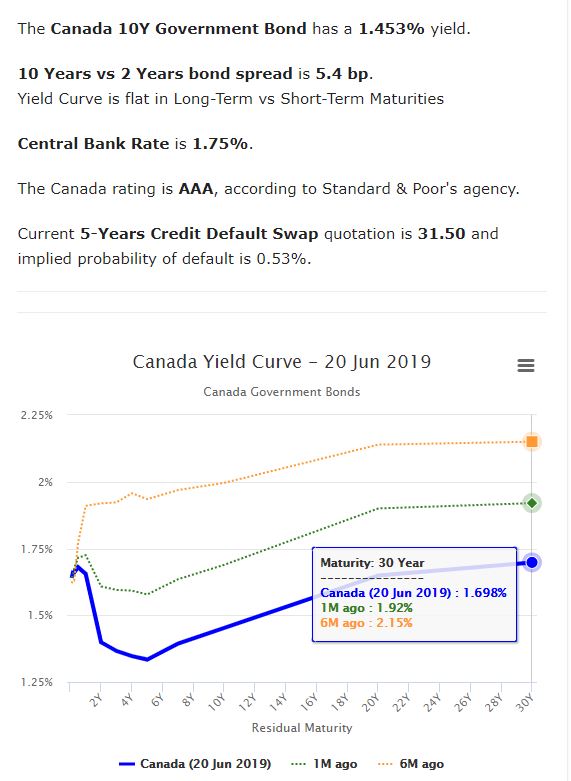

However, you will note that the total for 2019-2020 is only $78.9 billion. Yet the federal government spends nearly $300 billion per year.

The difference is effectively spent in provinces even when not given to provinces. This type of spending won’t show up as a transfer. For example, building a military facility or giving a large contract to SNC Lavalin.

You can go to Stats Canada for data on “Revenue, expenditure and budgetary balance — general governments, provincial and territorial economic accounts” to start getting a bigger picture, but this tool is also limited. However, it is probably the best one available.