Notley Defends Her Beer Tax

July 20, 2016 Leave a comment

By pointing to her new corporate welfare program for some Alberta brewers

(You get subsidies if you are small and stay small — that’s obviously helpful for one’s growth strategy!)

Markets, Freedom, and Truth

July 20, 2016 Leave a comment

By pointing to her new corporate welfare program for some Alberta brewers

(You get subsidies if you are small and stay small — that’s obviously helpful for one’s growth strategy!)

July 4, 2016 Leave a comment

Probably not. So-called “progressivism” has no guiding principle at all. It is driven by fickle emotions and a worldview that thinks you can have your cake and eat it too. There is no hard limiting factor with which progressives can judge if their frivolous proposals have gone too far. That’s why reasonable people think progressive demands and proposals are getting… progressively more laughable and absurd.

June 11, 2016 Leave a comment

The Alberta government, through the CIFFC, contracted 300 of the cheapest firefighters they could possibly get.

Everyone made a big deal out of these cheerful South African firefighters, who sang and danced upon their arrival at the airport. Hooray! How cool is that?

No one has said much about the fact that these firefighters were hired as part of a South African government job creation program called “Working on Fire.” They may have only been hired shortly before their departure for Canada (they arrived on May 29).

Are they real firefighters? We can’t be sure.

Once here, the workers go on strike because of their wages, which are pathetic by the standards of a comfortable Albertan (about $4 an hour, or $50 per day). Now they might all be going home.

Premier Rachel Notley says they contracted to pay the firefighters $170 per day + food and lodgings.

So the South African government is exporting its welfare firefighters and taking $120 per day off the top for each one. They must think the Alberta government is a bunch of suckers.

Notley, who apparently thinks everyone should pay $15 minimum wage except when her government wants cheap African thralls to fight fires, says she is going to fix everything. She claims she will somehow ensure the South African firefighters get paid the appropriate Alberta wage (which is small fortune to them — each day will equal almost a month of the average firefighter wage back in their home country).

Since the firefighters are paid by the South African government, this means the Alberta government will have to give money to the South African government. It’s probably fair to think the South African government is still going to skim “a little” off the top.

The South African government tells us not to worry, because that $4 per hour wage is just an “allowance”, and their firefighters still get regular pay at home (average 2,400 rand, or about $205 per month). The welfare firefighters are double dipping!

We’ve heard of people applying the broken window fallacy to natural disasters: “This wildfire is pretty bad, but fixing things will boost our economy!” Even those people wouldn’t be so daft as to suggest it would boost another country’s economy.

Who would have thought that a wildfire in Fort McMurray would lead to foreign aid for South Africa, letting corrupt bureaucrats enrich themselves at the expense of the Alberta taxpayer?

— Read more at CBC.ca —

June 7, 2016 Leave a comment

Alberta’s NDP government passed its carbon tax law today.

Many agree that it is one of the stupidest taxes ever created, however even many arguments against the tax accept the basic premise that CO2 is a negative externality and “something must be done.”

But what if the premise underlying the tax — not to mention any other “climate change” policy — is wrong?

What if the social cost of carbon is negative — i.e. the net effects of carbon are positive?

A new paper by Dayaratna, McKitrick, and Kreutzer finds reason to believe this is justified by the empirical data:

Substituting an empirical ECS distribution from LC15 yields a mean 2020 SCC of $19.52, a drop of 48%. The same exercise for the FUND model yields a mean SCC estimate of $19.33 based on RB07 and $3.33 based on the LC15 parameters—an 83% decline. Furthermore the probability of a negative SCC (implying CO2 emissions are a positive externality) jumps dramatically using an empirical ECS distribution. Using the FUND model, under the RB07 parameterization at a 3% discount rate there is only about a ten percent chance of a negative SCC through 2050, but using the LC15 distribution, the probability of a negative SCC jumps to about 40%. Remarkably, replacing simulated climate sensitivity values with an empirical distribution calls into question whether CO2 is even a negative externality. The lower SCC values also cluster more closely together across difference discount rates, diminishing the importance of this parameter.

This all makes perfect sense, because there are non-climate effects of CO2 and they are extremely beneficial to the planet (plant growth, crop yield, human well-being). Furthermore, the climate effects of CO2 observed in the real world are far less damaging than what’s been predicted by the models of climate change propagandists — and these too are largely beneficial. On this, see Goklany’s Carbon Dioxide: The Good News, from GWPF.

So using the logic of carbon tax advocates, since carbon provides us with overall benefits, we should subsidize carbon rather than tax it extra.

From the standpoint of economics and ethics, we should neither subsidize carbon nor tax it.

If you have a carbon tax, get rid of it. If you don’t have one but think you need one, forget it.

Carbon taxes are an abomination — they do nothing to improve the environment and exist only to plunder citizens so that politicians, central planners and cronies can enrich themselves.

June 6, 2016 Leave a comment

The government threatens citizens with fines and/or jail if they do not fill out the census.

A lot of people remarkably think this is a civilized way to collect information, but we’ll put that issue aside for now.

Here’s the hilarious thing, based on my own recent experience and reports from other individuals: If you tell a Stats Canada employee you have concerns about privacy or violent threats about not filling out surverys or anything like that, they will tell you to “make something up.”

I am no lawyer but I think this is illegal under Section 31 of the Statistics Act:

31 Every person who, without lawful excuse,

(a) refuses or neglects to answer, or wilfully answers falsely, any question requisite for obtaining any information sought in respect of the objects of this Act or pertinent thereto that has been asked of him by any person employed or deemed to be employed under this Act, or

(b) refuses or neglects to furnish any information or to fill in to the best of his knowledge and belief any schedule or form that the person has been required to fill in, and to return the same when and as required of him pursuant to this Act, or knowingly gives false or misleading information or practises any other deception thereunder

is, for every refusal or neglect, or false answer or deception, guilty of an offence and liable on summary conviction to a fine not exceeding five hundred dollars or to imprisonment for a term not exceeding three months or to both.

Isn’t that funny? The government will spend a lot of money telling you how important the census is for our country’s future and also threaten you if you don’t complete the census truthfully, because that’s a crime.

But government employees will tell you to make stuff up if you find the census obnoxious and immoral. Which shows they don’t really take the census or the law seriously.

So does the government even care about the census? Sounds like a pointless boondoggle.

The census is dumb.

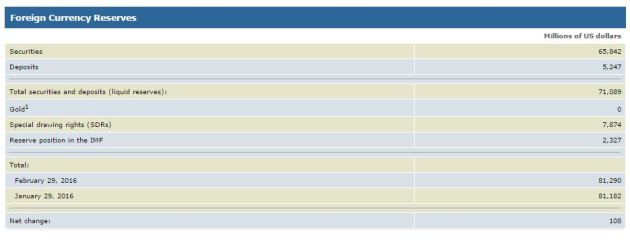

March 3, 2016 Leave a comment

As of today, Canada has no more gold reserves.

This is a process that has been going on since the 1960s, when Canada had 1,000 tons of gold reserves.

Now they have zero.

February 8, 2016 Leave a comment

A young Ontario girl with cancer recently died even though she had donors available for her needed bone marrow transplant.

The bureaucracy stuck her on a waiting list because the public healthcare system could not provide her with a hospital bed when she needed it.

Typical public healthcare.

CMR Law 22: Public healthcare means less healthcare. The system comes with a built-in incentive that favors dead patients — after all, when you’re dead, they don’t need to take care of you any more.

February 1, 2016 Leave a comment

The average is about $47 in real terms.

What does this tell us? Well, not much, except it’s the $100-ish prices that were more of an anomaly than the recent price situation.

— Thanks to David Stockman —

January 25, 2016 Leave a comment

Canada’s economic slowdown has been felt most fiercely in Alberta not only because of tumbling oil prices, but also the political factor. The NDP government is a classic embodiment of “regime uncertainty” — investment has contracted because capitalists cannot predict what new anti-business measure is next.

Despite the fact that Alberta offers few votes to buy, even the federal government is contemplating launching its infrastructure ‘stimulus’ plan in Alberta and Saskatchewan (the latter having also been hard hit by depressed oil prices, although its government is arguably less antagonistic) with $1 billion in spending.

Federally funded infrastructure boondoggles will do little or nothing to help Alberta, but let’s put that aside for now. The real source of trouble is low oil prices, lack of pipelines, and provincial government policy.

Nothing can be done about oil prices. Demand has not grown as quickly as anticipated, but mostly the positive supply shock weighs heavily on the price.

Likewise, little can be done at this time about the pipeline issue. Myriad stakeholders are determined to have a de facto embargo on Alberta, and that is not going to change any time soon.

The NDP government, however, could quickly and easily take action to accelerate investment in the Alberta economy. This can be done unilaterally and it doesn’t even matter what oil prices are or whether any pipelines get built.

Notley’s NDPs government made a disastrous decision of imposing higher taxes immediately upon taking power. Higher income taxes, both individual and corporate. Taxes on gasoline. Sin taxes. The new carbon tax is also a sin tax, by the way, much like tobacco and liquor, at least in the eyes of the radical environmentalists. Fortunately, they at least eliminated some of the tax hikes in Prentice’s PCs’ budget, such as the healthcare tax.

Taxes do not occur in the abstract, but greatly influence present and future decisions. While companies that lose money won’t pay corporate income tax (thus implying little or no new net revenue), the higher tax rates will deter future investment. This is exactly the opposite of proper policy.

The government should immediately cut all taxes. Not only to the previous level, but much lower. At a minimum, they should get rid of personal and corporate income taxes completely. Investment and private consumption would dramatically increase and the positive impact would be immediate.

As many other taxes should be cut as possible. Gasoline taxes, resource production taxes (aka royalties), carbon taxes, insurance taxes, even popular sin taxes. But eliminating the personal and corporate income taxes should be the top priority.

Such a law could be fit onto a single page and could be written in an hour. The government could convene for an emergency session and pass the law at once. The whole process need not to take longer than a week.

This would have an immediate effect. New capital investment would flood into Alberta even if oil went to ten bucks a barrel. While the capitalists wouldn’t make any money right away, their investments will entail new projects and entrepreneurial efforts now. This means hiring more people, buying new equipment, and producing more goods in the present. Unemployment would fall rapidly, supply chains would kick into high gear, and myriad investments that have already been put on hold or cancelled entirely would resume while numerous new ventures would flourish.

Within a year, Alberta would again be the province of unparalleled economic growth and and unprecedented prosperity.

Furthermore, these policies would benefit all Canadians. Making Alberta extremely attractive to investment would strengthen our currency because investing in Canada requires Canadian dollars. The Canadian dollar is getting killed this year by various factors, but one of the reasons is due to Canada’s lowered attraction for investment. Alberta has a disproportionate effect on this because Alberta because it’s the province that has received the lion’s share of capital spending for the last 10 years. Increasing the demand for Canadian dollars would increase consumer buying power and therefore enrich all Canadians.

There are many beneficial actions the government could take to help Alberta, but these tax cuts could be implemented easily and quickly and their impact would be the most quickly felt.

And here is the most important part: it wouldn’t matter what the oil price is, whether pipelines get built, or what the federal government does. Not only would this restore vigor to Alberta’s strained oil and gas industry, but all other sectors of the economy as well.

Obviously this would be only the first step in making Alberta the incontestable economic powerhouse of Canada. The NDP government must also dramatically cut spending and regulations. Pipeline companies and private property owners must be allowed to reach agreements on their own about pipeline projects with zero input from phony stakeholders such as US-funded radical environmentalists.

But those are issues that would take time to resolve. But taxes can be cut instantly. And that is what must be done.