Carney is off to the Bank of England — Pray for England

November 26, 2012 Leave a comment

Bank of Canada Governor and ex-Goldman bankster Mark Carney was selected to become the next Governor of the Bank of England. He will now be overseeing a central bank with nearly ten times the assets of the Bank of Canada. That is a big promotion in the world of central planners! Carney will now be able to create even larger disturbances in economic systems.

Truly, the worst rise to the top.

Good riddance, I say. Not that I expect him to be replaced with anyone much better. But there is always a chance.

I feel bad for England, though. They have no idea what they are getting themselves into (from Bloomberg):

Carney, who holds an economics degree from Harvard and a doctorate from Oxford University, swaps oversight of an economy which bounced back from the global recession without witnessing a single bank bailout for one which slipped back into recession in the second quarter and required multiple bank rescues.

Did you see what they did there?

Carney … swaps oversight of an economy which bounced back from the global recession without witnessing a single bank bailout for one which slipped back into recession in the second quarter and required multiple bank rescues.

…

Carney … swaps oversight of an economy which bounced back from the global recession without witnessing a single bank bailout …

…

an economy which bounced back from the global recession without witnessing a single bank bailout …

…

without witnessing a single bank bailout …

Excuse me? The banks that pushed for Carney to be their man in England have surely put the shucks on the rubes.

Of all the deleterious myths that persist about the Canadian financial system, none are more harmful or obnoxious than the bogus story that its banks never needed and/or never got a bailout.

Anyone who says this is simply lying or has no idea what they are talking about. Those are the only real possibilities. We have covered this at CMR previously, but let us quickly review.

The mainstream news doesn’t even try to deny it anymore. The Canadian banks got a bailout. Now they simply try to play down the significance of it. Even though it is was much bigger than anyone was led to believe.

So is this “no bailouts in Canada” proposition challenged by anyone in the UK? Carney is being sold on the pretense that there were no bailouts?

(Side note: We could also mention that Canadian banks received assistance from emergency Federal Reserve lending facilities, which by itself is very interesting. We could also mention that rather material fact that Canadian banks are basically in a state of “perma-bailout” by virtue of the Canadian Deposit Insurance Corporation. The existence of the CDIC amplifies the level of risk banks are willing to engage in — it is classic “moral hazard.”)

So it would seem one is more likely to see bank bailouts with Carney, rather than less. That is precisely why the UK banking cartel wants Carney in this position.

Yet that is not the only reason citizens of the UK should worry.

Mark Carney is not only a believer in bailouts — he is a believer in Keynesianism and mercantilism. This means nothing more than this: he sees a connection between depreciating the currency and growing the economy. This he shares with nearly all central bankers (except, perhaps, those in Singapore): he regards a strong currency as harmful to “the nation”. Because when he talks about “the nation,” he is not talking about the consumers (i.e. everyone) who use their stronger currency to buy and invest in more goods. For men such as Carney, “the nation” instead refers to politically-connected export industries that are benefited by making it cheaper for foreigners to buy their stuff.

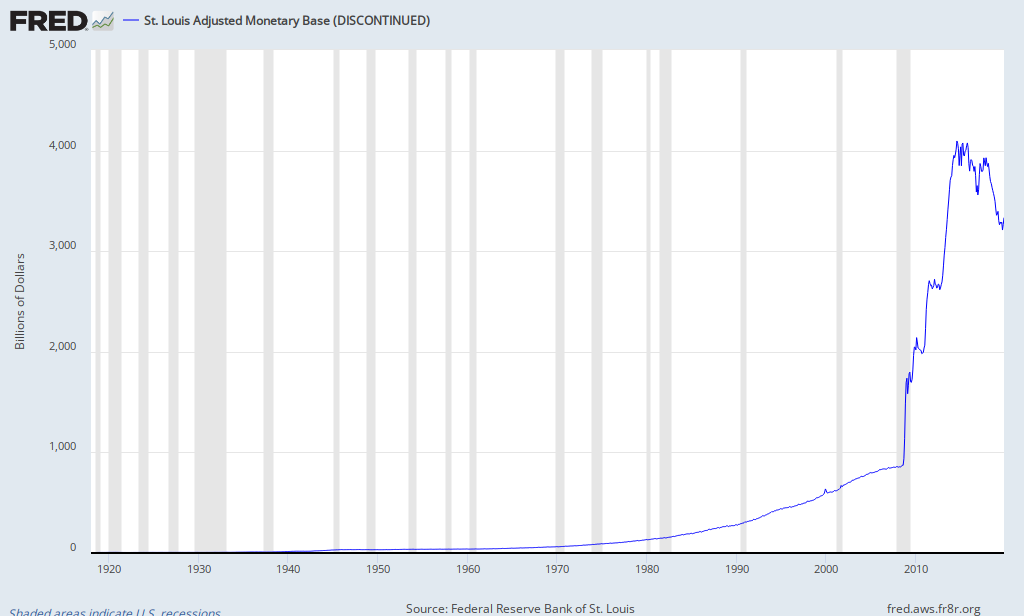

That being the case, Carney will tend to increase the money supply by adding assets to the central bank’s balance sheet whenever he thinks it’s a good idea. But this means prices must rise and debts will deepen. Britain already has big problems in these areas.

This should be the last thing someone in the UK should desire. The British pound has plummeted in value the last five years against stronger currencies like the yen. Here in Canada, it seems Carney’s manipulations have been obscured by strong demand for Canadian commodities, yet with the slowdown in Asia, Europe, and soon the US, I doubt this will persist. The Bank of Canada has been growing its balance sheet for nearly two years now, since offloading some of its emergency acquisitions during the financial crisis.

Also, it should be known that Carney likes to troll citizens whose currency he manages by blaming them for behavior that is strongly encouraged by his own central bank policies. What a jerk.

I am happy to see Carney go. While I am happy he no longer oversees the Canadian dollar, I am apprehensive about who his replacement will be. Most of all, I must also bemoan the lack of justice. Carney should be serving a prison sentence for counterfeiting, rather than getting $1 million a year to manipulate huge economies.