It’s entirely possible I don’t have the time to write this right now. Poor me. But this is important, so I must make the time.

So listen up people. Time for STRAIGHT TALK. It’s important to get the facts straight because it gives us a chance to understand something about economics and do some critical thinking.

What am I talking about? Well, a lot of folks of an anti-Fed persuasion, and even some Fed-lovers, say we have “artificially low interest rates.” Among the generally economically literate folks who are my friends and acquaintances, I constantly hear “artificially low interest rates this” and “artificially low interest rates that.”

Is the interest rate distorted? Yes. But is the Fed the reason interests rates have remained so low?

The answer is no.

“But!” you say, “Bernanke is printing so much money! That money is used to buy bonds, which pushes down interest rates!”

Okay, I am going to blow your mind here: The Federal Reserve is not printing money. They have not added made any net additions to their balance sheet since the end of QE2.

In fact, the Fed has deflated! That’s right… they have sold debt, and reduced their balance sheet.

WHAT!

It is true. I will now proceed to show my evidence:

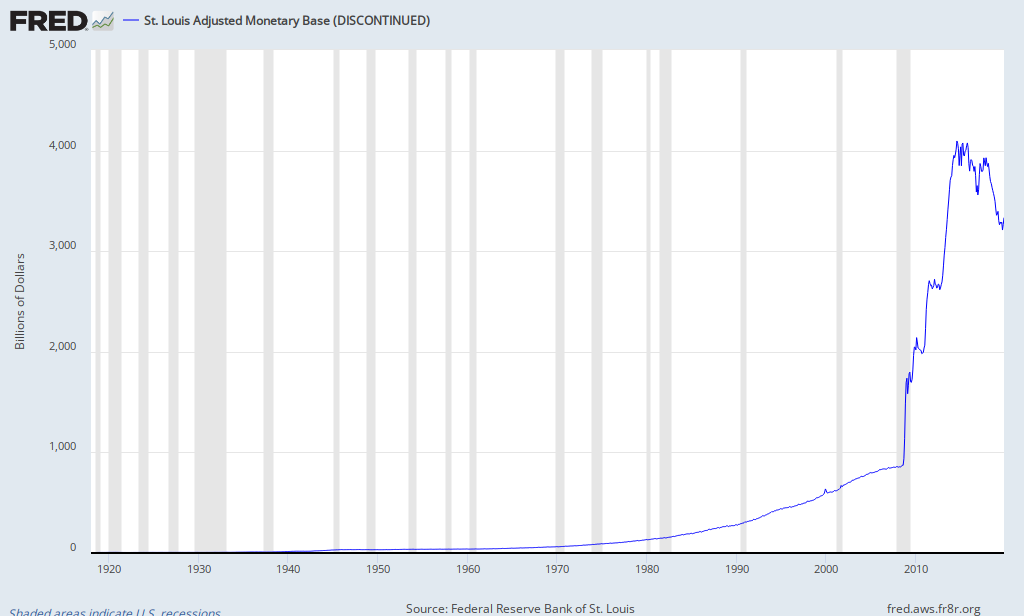

First, let us look at a long-term chart of the monetary base.

Here we see the monetary base has skyrocketed since 2008. The first giant spike is what we retroactively call “QE1,” the massive purchasing of mortgage-backed securities during the financial crisis.

You’ll note there was a temporary reversal of such debt-buying just before the second huge spike: QE2, which spent $600 billion on US government debt. Again, following this spike there has been a reduction in the size of the Fed’s holdings.

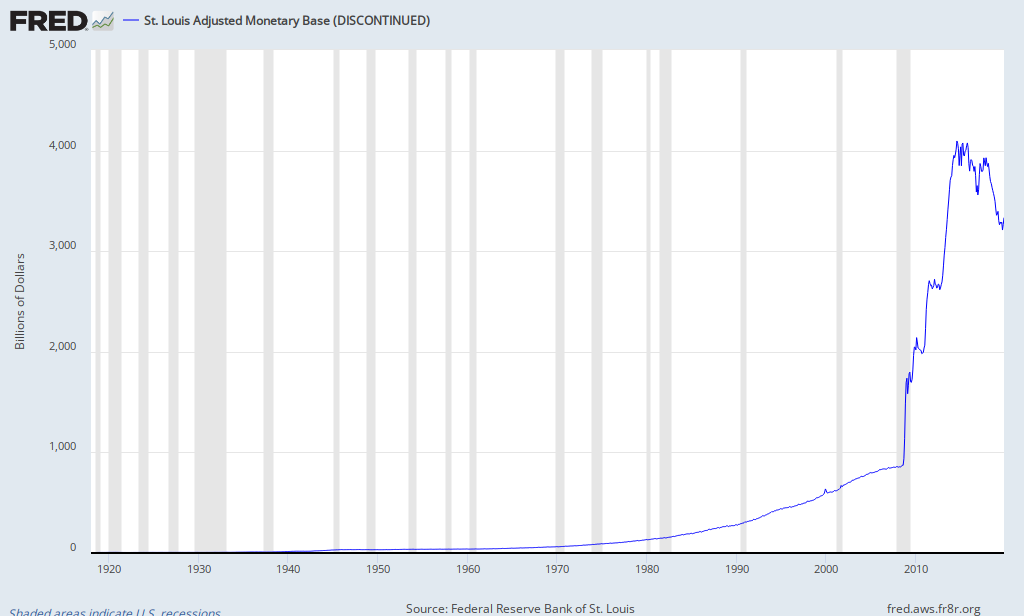

Now let’s “zoom in” to the end of QE2.

So from Summer 2011, we have not seen the monetary base increasing. The Fed has been jerking around the amount, but since the end of QE2 the total assets of the Fed has tended downward.

What about QE3? Well… what about QE3? As far as I can see, it either has not even started yet, or it is being offset by the sale of other Fed assets. In any case, the grinding weight of the American economy already has the recessionary momentum, and $40 billion a month isn’t going to matter.

That is why America is certainly entering a recession in 2013, and so Canada will also.

If this is true, and if it is also true that the Federal Funds rate has stayed the same the entire time, then something else must be keeping interest rates as low as they are. The contraction of the Fed’s balance sheet should cause the interest rates to rise. So what could it be?

It’s not actually a big shocker: the economy is extremely delicate. Extremely delicate. That’s because everything seems to depend on the whims of politicians and bureaucrats who will either:

- Pump more crack into the financial system and eke out a bit more cancerous economic ‘growth’, OR

- Let a depression come and bring the economy to its knees. Or another crisis will come and the economy will be brought to its knees anyway.

So what Robert Higgs calls “regime uncertainty” is at critical levels, forcing low growth and keeping unemployment high. Additionally, the huge banks don’t trust each other because they are all fundamentally broke and the financial system is such a twisted nightmare. Virtually all the money added by Bernanke has printed been packed into the banks excess reserves.

Could it be the case that if Bernanke were not paying interest on the banks’ excess reserves, that interest rates would rise? Probably not. They are already losing money by parking their reserves at the Fed. But they prefer to lose just a tiny bit of money, rather than a lot of money in a highly uncertain economy.

The same way investors will give their money to Geithner — GEITHNER, of all people! — for a negative real return. They would rather know they will gain nothing, or lose a percent or two, rather than lose 20% with some fund manager.

The Great Depression also saw record low interest rates, so the present state of affairs should surprise no one.

Now just to clarify, I am not defending Fed policy, I am not defending Bernanke. I loathe central banking in principle. Deflation, i.e. reducing the money supply, is not necessarily a good thing. Yes, falling prices are good. Yes, inflation is bad. But if you are going to have a central bank, then policy should be to maintain a stable money supply, and let the market determine the value of the currency. Reducing the money supply through open market operations is just as much of an intervention in the market as increasing the money supply, it just affects different people in different ways. For example, the debtor prefers inflation, the saver prefers deflation.

That being said, the money supply has been RELATIVELY flat now for over a year. When we’re talking about Ben Bernanke, isn’t that pretty much the best we can hope for? Much better than him flying around in his helicopter throwing trillions of dollars at the world’s problems, like he did up until mid-2011.

Don’t get me wrong. The Fed is still creating distortions, for example by buying up nearly all the 30-year Treasury bonds with the Twist program, and affecting prices of different assets. But… relatively speaking, the Fed is not causing too much trouble at the moment. Silver linings, I guess. If they let us go into a recession and come out of it the natural way, that would seriously be pretty swell.

I also believe that the Fed will print when they think they “need” to, but for the moment they are relying on PR and promises.

Remember, according to the Austrian theory of the business cycle, you can only maintain the “boom” phase by ever-increasing expansion of the money supply. You cannot raise then money supply and then stabilize it. You can’t even increase it at the same rate the entire time. Monetary policy must become more aggressive as the boom matures, and becomes more and more unwieldy. Otherwise, the bust inevitably comes.

Moving on, when the Fed announces it will maintain its target Federal Funds rate, it does not mean that their actions are determining what the actual rate is at the moment. That is the case now. They trick people into thinking they have it under control, but they don’t. The actual rate is determined by the overnight lending of the banks.

But when rates do start to rise, the Fed won’t need to print anymore money. They already did. The two trillion dollars they’ve added to the system will come flooding out, and by the magic of fractional reserve banking the entire universe will explode in 10 minutes in a reserve currency hyperinflationary apocalypse. The Fed won’t let that happen — if they still exist, they will crash the economy with Great Depression II to save the big banks. Remember, the Fed is there to protect the big banks. It is not there for “full employment” or “protecting the financial system” per se. Hyperinflation would destroy the big banks so it must be avoided from a central bank standpoint. High inflation on the other hand…

Anyway, hopefully CMR has been able to clear up this complex issue for some people.